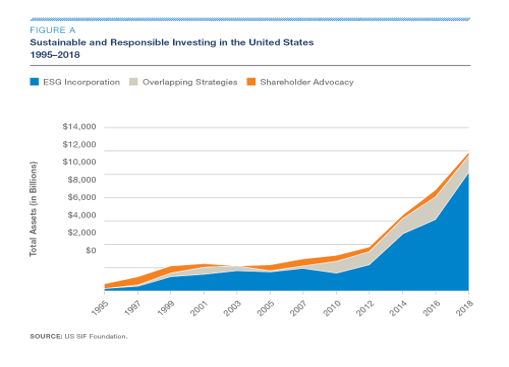

Our trade organization, USSIF, the US Social Investment Forum, puts out a biannual trends report, which examines the state of the Responsible Investing movement.

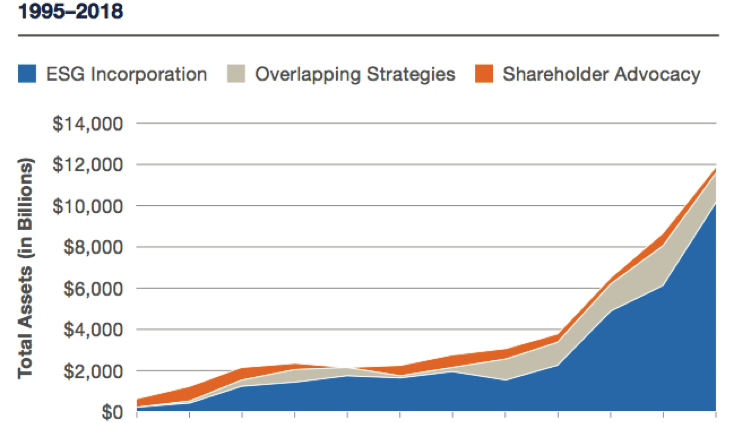

The highlight of the report is this image, which shows the exponential growth of Sustainable and Responsible investing in the US:

At the time of publication, almost $12 Trillion dollars is invested in responsible investing strategies in the US, which represents an 18-fold increase since 1995, and 38% growth since 2016, the last time this report was published. In fact, 26% of all assets under professional management in the US are now incorporating Environmental, Social and Governance data into their investment process in one way or another.

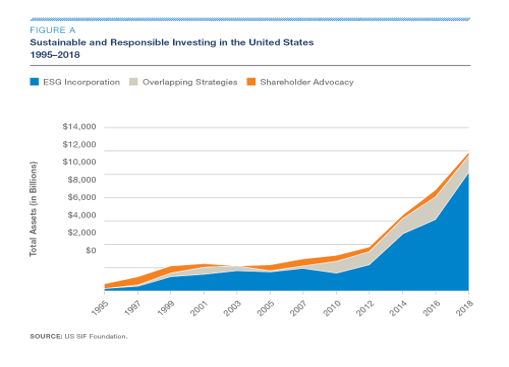

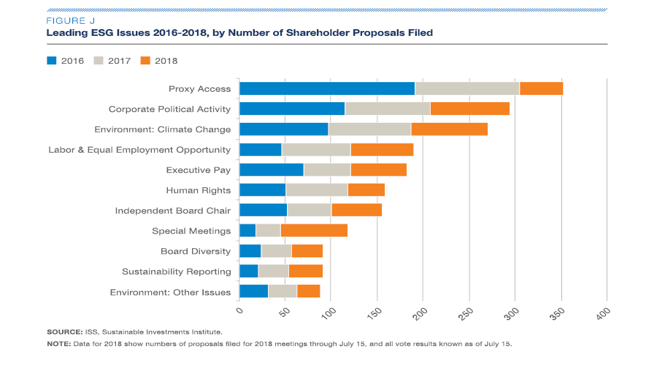

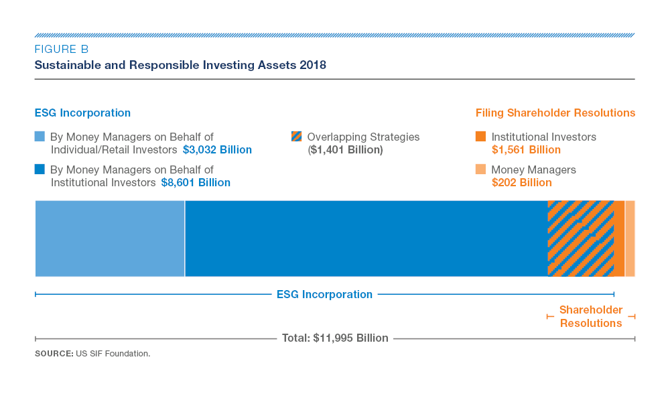

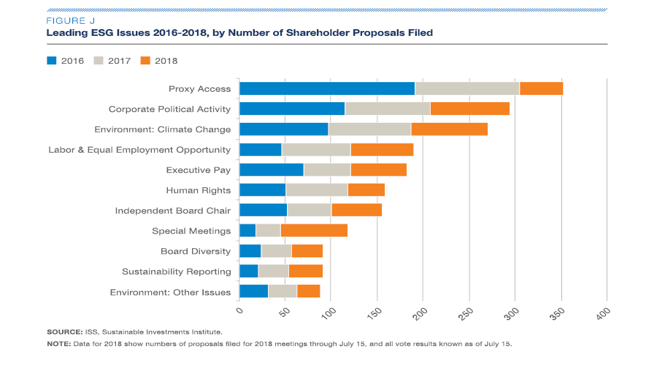

It’s important to break that data down further. This chart is a snapshot of 2018, which examines who is investing in these strategies, and whether those investors are merely using ESG data in their investment process, or whether they are engaging with the companies they own in their portfolios to try to change corporate behavior: We are THRILLED to see such huge numbers on this chart. In fact, the data has changed so much since the last report that it’s really worth digging deeper into the orange slices at the right to see what change is being created in the world. By examining shareholder resolutions, one tool investors use to make companies to change their behavior, we can see some of the priorities that the industry and institutional investors have set over the last few years:

We are THRILLED to see such huge numbers on this chart. In fact, the data has changed so much since the last report that it’s really worth digging deeper into the orange slices at the right to see what change is being created in the world. By examining shareholder resolutions, one tool investors use to make companies to change their behavior, we can see some of the priorities that the industry and institutional investors have set over the last few years:

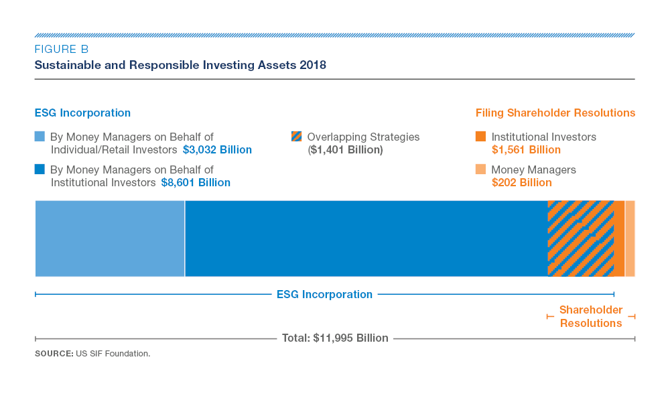

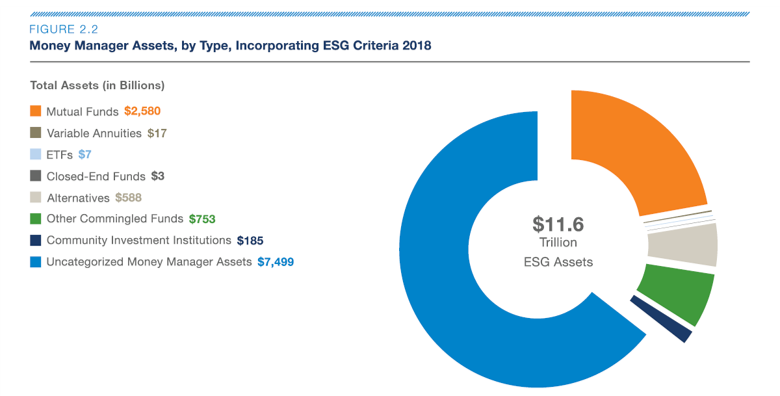

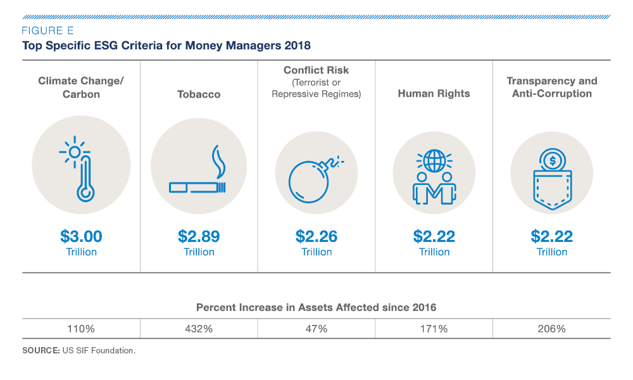

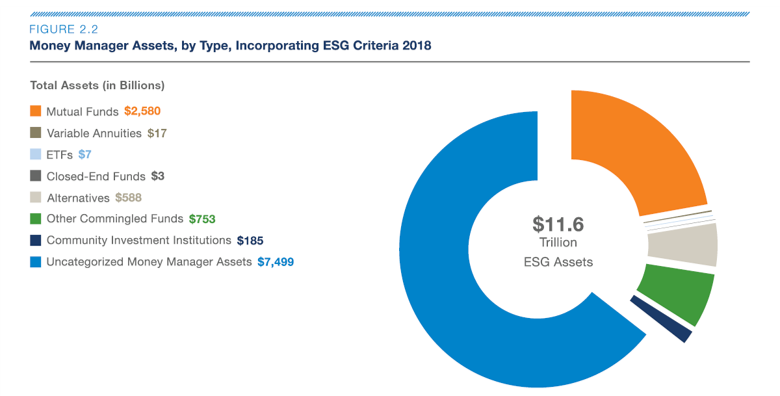

This chart looks at Money Manager activity, which matters a great deal to us, as this is the category we fall into. In fact, as a firm, we contributed to this report through our continued membership in the United Nations Principles for Responsible Investment (you can view our data here), which was one of the primary sources for this report.

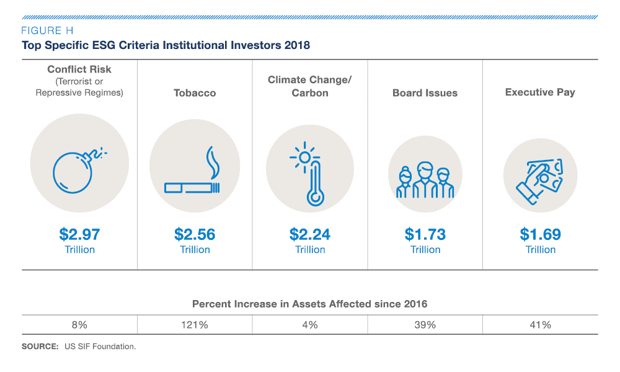

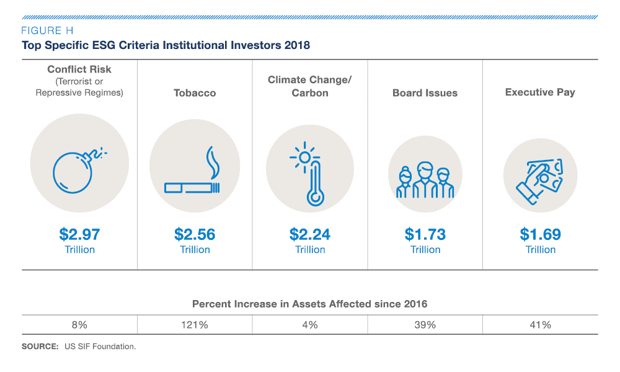

Interestingly, Institutional Investors, had much different priorities:

Clearly, both groups take similar sets of issues seriously, but institutional investors place a greater priority on Governance issues than money managers. In our view, institutional investors are well suited to working on governance issues, as they tend to be long term issues that require longer term engagement.

Breaking this work down into more detail also yields insights: battles over Proxy Access have slowed down after strong investor support. The share of S&P 500 companies with proxy access policies grew from 1% to 65% from 2013 to 2017, so activity on this front has slowed as a result of having fewer targets to engage. This is a win!

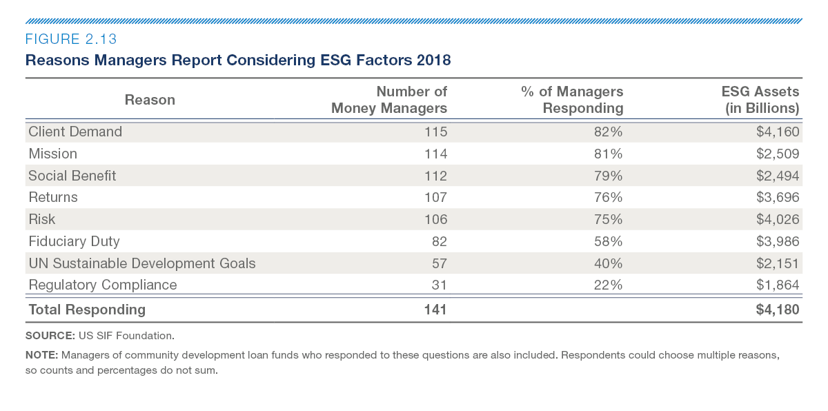

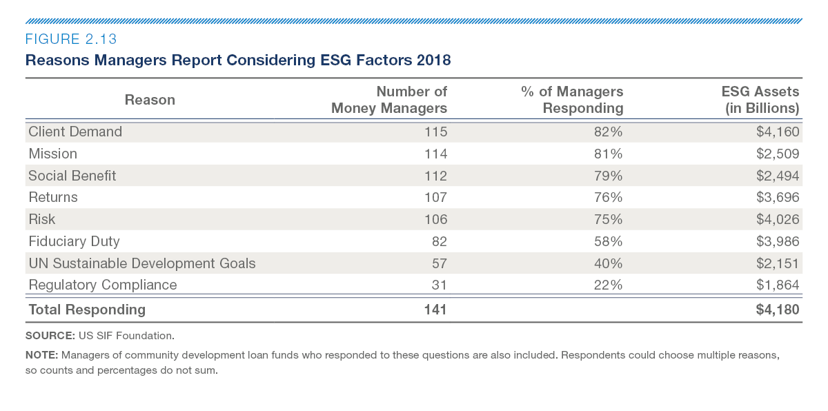

In many ways, while what has been accomplished is important, why investors are pushing for change is more interesting. 82% of managers report client demand as a factor, while three quarters cite risk and return separately. This means that your voice as a client can make a difference! By joining with the larger community of actively engaged investors, you can become a part of a community that is creating grassroots change within the financial services industry at large.

When it comes to Risk and Return, we agree that long term investors should be considering Environmental, Social and Governance data in their process, as our investing thesis is based on the premise that using this data can expose risks to the long term prospects of companies we own in our portfolios. All investing involves risk, and our job is to manage that risk. We believe that ESG can be one more tool in the risk manager’s toolkit to help understand and manage risk, and we’re glad to see that this opinion is shared more broadly.

The data still has some problems, however. Looking at the types of assets that are incorporating ESG, by far the largest segment is “uncategorized money manager assets”, which is a term that’s exactly as vague as it sounds. While Mutual Funds, ETFs, Closed End Funds, Alternatives, and Community Investment Institutions all issue a Prospectus which discloses how they use this data (and we spend a LOT of time reading these documents to verify that our partners have policies in place that our clients want to see), the Uncategorized segment is largely self-reported, through a box on the Principles for Responsible Investing reports that says the managers are looking at the data, but not how they use it. You can view our PRI Transparency report here. We welcome your feedback!

All in all, this trends report marks a HUGE step forward for the industry, but a lot of work remains to be done. Additional highlights of the report include:

- Higher support for Environmental and Social proposals: The proportion of shareholder proposals on social and environmental proposals that receive high levels of support has been trending upward.

- Equal pay: Several companies have agreed to report on—and correct—gender pay differentials in response to shareholder resolutions.

- Engagement: Behind the scenes, engagement is increasing: 88 money managers, with $9.1 trillion in AUM, reported that they engage in dialogue with companies, up from 61 money managers, with $6.1 trillion in AUM, in 2016.

Additional information on this report can be obtained by contacting us, or US | SIF: The Forum for Sustainable & Responsible Investment at info@ussif.org or (202) 872-5361. The trends report website is www.ussif.org/trends and they can be found on twitter: @US_SIF | #USSIFtrends2018

The Center for Effective Altruism

The Center for Effective Altruism