How do we “ESG”?

We talk a LOT about Environmental, Social and Governance data here, including how that data can be used to manage risk and some of the different ways that we as investors can use that data to align our clients’ investments with their values. Recently, I had a chance to sit down and talk with a pair of colleagues I’m proud to call friends and talk about our personal stories and the journey we’ve taken to understand and use this data. It was a fantastic conversation, and one that’s well worth a listen.

From the show notes: Investors and advisers are more interested than ever in putting their money to work to better the planet and the people living here. While there’s lots of talk about “making sure your money aligns with your values,” there’s very little talk about how to actually do so. Where does one find the data on environmental impact, carbon emissions, social justice, diversity, community impact, biodiversity protection (or harm) and all the other critical ESG metrics when making an investing decision? What does that data look like? How should one weigh those metrics against basic financials? In short, how does one actually go about ESG investing?

If you prefer to listen on the go, you can also get this podcast on most of the major podcasting platforms, including:

Bonus points if you reach out to me to follow up on what I asked all listeners to do!

Common Interests recognized as a “Best For The World™” B Corp for excellence beyond just profit

We are excited to announce that Common Interests has been named a Best for the World™ B Corp for the 5th time in a row in recognition of our exemplary performance beyond commercial metrics. Ranking in the top 5% of all B Corps in our size group worldwide for sustainable business practices, we have earned this honor because of initiatives such as our sliding fee scale, which bases our hourly fees on our clients’ ability to pay, our lack of an investment minimum, and our commitment to democratizing access to impact investing & financial planning.

This honor is the culmination of many years of work, and is the first time since we moved to Vanderbilt Financial Group in 2017 that the work we’ve put in to raise our scores has been reflected. B Corps are required to recertify every 3 years, and our most recent recertification, which began at the end of 2019 and was completed in February 2020 (which explains why we haven’t had time to talk about it until now), resulted in a 39.5% increase to our scores. We’re extremely proud that our new scores (which you can view here), continue to keep us as a Best for the World B Corp, even as the criteria for this honor have tightened.

The Best for the World recognition is administered by B Lab, the global nonprofit network that certifies and mobilizes Certified B Corporations, which are for-profit companies that meet the highest standards of social and environmental performance, accountability, and transparency. Today there are more than 4,000 Certified B Corporations across 77 countries and 153 industries, unified by one common goal: transforming the global economy to benefit all people, communities, and the planet.

B Corps meet the highest standards of verified social and environmental performance, public transparency, and legal accountability to balance profit and purpose. The B Corp Certification doesn’t just evaluate a product or service, it assesses the overall positive impact of the company that stands behind it—like Common Interests. Using the B Impact Assessment, B Lab evaluates how a company’s operations and business model impact its workers, community, environment, and customers. To achieve the B Corp Certification, a company must achieve a score of at least 80 points on the assessment.

“Best for the World is a special program for the B Corp community, and we’re thrilled to resume it after pausing the program in 2020 due to COVID-19. This year’s Best for the World companies are operating at the very top of their class, excelling in creating positive impact for their stakeholders, including their workers, communities, customers and the environment. We’re proud of the community of stakeholder-driven businesses we’ve cultivated over the last 15 years; together we’re marching toward our collective vision of an inclusive, equitable and regenerative economic system for all people and the planet.”

~Juan Pablo Larenas, Executive Director of B Lab Global.

More than 800 B Corps from more than 50 countries were named to the 2021 Best for the World lists, including 4G Capital, KeepCup, Natura, The Big Issue Group, TOMS, Too Good To Go, and Patagonia. The 2021 Best for the World lists are determined based on the verified B Impact Assessments of Certified B Corporations. The full lists are available on https://bcorporation.net/.

Watch the Official Selections of the 2020 ESG Film Festival!

These are the films from the 2020 ESG Film Festival, presented on Dec 3rd. From 508 entries, these 12 films were selected to showcase the power of ESG and Impact, and inspire audiences around the world to act. Every action we take has power.

As a member of the advisory board for this event, I helped to judge the film festival we presented at the event. We’re proud to present the films we selected below. Films denoted with Honorable Mention were not screened live due to time constraints, but were deemed on merit worthy of inclusion here.

Flowers in the River This film won both the Judges Best Film & Audience Choice awards!

Directed by: Tiffany Steeves & Andrea Chung – United States. Ankit Agarwal, founder of Phool, shares the story of the flower recycling business he created and the impact it is having on the Ganges River in India

Making of ‘Flowers in the River’

The filmmakers behind the documentary that won both of the awards at the 2020 ESG Film Festival share where the story idea came from, how they made the film, and a valuable life lesson learned along the way.

Seeding the Sea

Directed by Sarah Redmond & Caroline Almy – United States.

Off the coast of Belize, seaweed farming is a more sustainable alternative than fishing. Lowell Godfrey grew up there, and now owns his own seaweed farm that he hopes will inspire other fishermen

The Voice Of The Voiceless

Directed by Dalton Tokarcyzk – United States.

Indie rapper Marcel “FloStorm” Jones reflects on his experiences as a protestor who was arrested during the George Floyd-inspired protests during the late spring of 2020

Gando

Directed by Teymour Ghaderi – Islamic Republic of Iran.

In the Sistan and Baluchestan provinces of Iran water is scarce. However, where there is a Gando, an Iranian crocodile, there is water. The girls who fetch it risk life and limb.

Dry Tears of the Aral

Directed by Danila Volkov – Russian Federation.

The shrinking of the Aral sea over the last 60 years is the ‘most staggering disaster of the twentieth century,’ (UNDP) and has turned the lake into a toxic salt plain. Mr. Kamalov fights for the lake.

Waste Warriors of Bangalore

Directed by Goutham Varrier – India.

The people who work tirelessly to keep Indian cities clean often lead a very difficult life, with poor income, and no social security. Indha Mahoor and the NGO Hasiru Dala want to change that

Embers

Directed by Lexie Chu – United States.

A look back on the devastating 2018 Southern California fires through the eyes of animal rescuers.

Be Bold and Win the Dream

Directed by Novera Hasan Nikkon – Bangladesh.

A group of young girls in one of the most remote villages of the northern region of Bangladesh organized under the banner of a football team to stand against the gender discrimination present in their society

Iceberg Licking Society

Directed by Nathan Ceddia – Iceland. *Honorable Mention

A never before seen look into the mysterious world of the Iceberg Licking Society as the association faces iceberg-licking’s greatest threat: global warming

90 Minutes Without Meat

Directed by Dan Botterill – United Kingdom. *Honorable Mention

Football club Forest Green Rovers are known for being the world’s first carbon-neutral football club, as well as only serving plant-based fare during matches.

What About My People?

Directed by Tiffany Steeves – United States. *Honorable Mention.

Lerang Selolwane, co-CEO of Lucient Engineering in Botswana, shares his personal journey and vision for his country.

Te’la

Directed by Peter Okojie – Nigeria. *Honorable Mention

The short story of a young man that came from the northern part of Nigeria and migrated to Lagos state, one of the fastest growing cities in Africa, for a better future.

Our 2021 Wish For Everyone

We believe that 2021 will see a strong resurgence of environmental awareness. We hope that reading this will inspire you to get personally involved. NOW is the time to start remediating all that has been done to our planet and the people on it.

We, as a firm, are working very hard to do just that! We want to lead by example and demonstrate some steps we have taken in the last year which we are particularly proud of. Taking the first step is important, but we want to come back and report on our continued efforts. If we can do it so can you! There are no secrets here!

In our office and at my home, you will find evidence of our commitment to Sustainability. If you haven’t seen my first post, click here to learn about my new Prius Plug-In Hybrid. I’m thrilled to report that between 12/21/19 and 12/21/20 I have only used ⅔ of a tank of gas! The Pandemic helped, but so did the fact that I am only 10 miles from my office! What’s even more amazing is the fact that this car actually cost almost the same as the regular Prius I had at the time I bought this one!

Another step I took at home in 2020 is the solar panels I installed on my roof. This is an excellent example of using Other People’s Money (the best kind of money) to enhance financial wellness, as my utility company installed them, they guarantee them and will repair them as needed for the next twenty years. They also stay with the house if I choose to sell it. I put no money down to get them installed, and for the use of my roof, I get “credits” against my electric usage. This is an easy step that anyone can take!

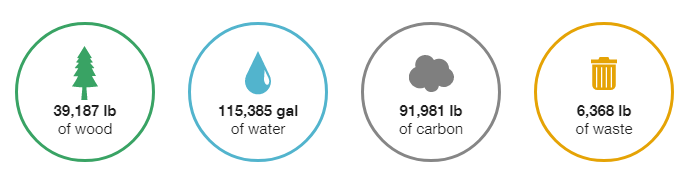

You will find the same focus in our office. We have LED Lights throughout (in fact, we just replaced the last legacy fluorescent bulb when it failed), we chose to locate our office next to the town’s recycling center, use reusable personal items, and our electricity is generated by Wind Power through a firm called Arcadia Power, who lets us track our usage and compare ourselves to typical consumers in our area. In addition, through our use of Docusign for all of our paperwork, we have reduced our waste significantly. Here’s a quick look at what we DIDN’T use in 2020 across our organization just by using Docusign for all of our paperwork:

To quote an old saying, “you can tell about them by the company they keep”. Let’s look at this list! A good starting point is our membership in the Principles for Responsible Investment and support for the United Nations Sustainable Development Goals. We Also belong to US SIF, the Forum for Sustainable and Responsible Investment, as well supporting the Ceres Charitable Foundation and Environment America. Lastly we are an award winning Certified B Corp whose mandate is to make our business a BENEFIT to consumers World Wide. (click here to see our scores and how they have changed over time).

One of our main goals for 2021 is to continue to work with more organizations working to advance solutions to environmental and social issues. In this regard, we would like to take our clients and friends along with us, figuratively if not in person! Let us be your leader, all you need to do is follow our progress on our blog and take inspiration from our Impact Reports.

Here’s to a year of global recovery!!

Remembering John Lewis

The world lost a great leader this week when Congressman John Lewis passed away. Lots of words have already been written honoring him, and others will do a better job than I can explaining why his legacy matters, and how we as a country can honor his legacy. I strongly encourage you to read the articles I’ve linked to, but the purpose of this post is to tell a personal story, and share how he touched my life, and how he helped to set me on the path I choose to walk to this day.

When I was 11, I had a unique opportunity to shadow Representative Lewis for a day and cast 4 votes on his behalf on the floor of the House of Representatives. The bill of the day was the Patients’ Bill of Rights, which for the first time gave patients the right to sue health insurance plans that cause injury by denying care or providing substandard treatment.

The day itself was a whirlwind, but a few moments are crystallized in my memory, sitting in Representative Lewis’s office and feeling, for the first time (although definitely not the last), the weight of history, and the struggle it took to build a country that values inclusiveness, and stands against racism. As I watched a video his staff had made about his life and legacy, I was inspired to use my life and career to participate in his work. I didn’t know how at the time (I was 11 years old after all), but my experiences that day have inspired me ever since.

I was lucky enough to spend the entire day with him, including a private tour of the capital, a ride in the Congress-only elevator and walks through the tunnels that run under DC. The entire day I listened to his stories, to his journey, and his passion. Spending a day with a living legend, who walked with Dr. Martin Luthor King Jr., gave me a sense of connection to that fight, and an understanding that it is not yet over.

As I looked back through my parents’ photo album from that trip (and thank you mom, for the time you put in to preserving these memories), I was struck by the picture below, by the expressions on our faces as we looked up at the capital. This picture captures John Lewis’s energy, and the hope and passion he inspired in me. He truly led by example.

Across everything I’ve read in the days since his passing, one quote spoke to me more than all the rest, and it’s what I’ll leave you with. I am proud to count myself as one of the people the President is referring to here, when speaking of John Lewis’s Legacy:

“He loved this country so much that he risked his life and his blood so that it might live up to its promise. And through the decades, he not only gave all of himself to the cause of freedom and justice, but inspired generations that followed to try to live up to his example.”

Where to buy sustainable PPE & support communities that need your help

We’re proud to be a Certified B Corp (see our scores here), and we try to raise the visibility of members of this amazing community whenever we have the opportunity. Today, we’re highlighting companies in the B Corp community that have shifted to producing sustainable Personal Protective Equipment (PPE). If you are in need of PPE, and want your dollars to support small businesses with a social mission, check out the list below, which is maintained by the folks at B Lab. The list notes the order sizes each have available, and whether the firm employs individuals in highly impacted communities.

As always, we don’t receive compensation for this kind of thing, and we won’t earn a commission or anything else as a result of this effort. We’re just putting this out because we believe it’s the right thing to do.

What we’re doing internally and the importance of planning

In the spirit of full transparency, we thought it would be worth taking a minute to discuss how Common Interests has prepared for emergencies.

- Our first priority is the security of our clients’ accounts and our ability to provide access and up-to-date information in times of crisis. To this end, we have conducted rigorous due diligence on our partners, and have evaluated their business continuity plans. We invite you to read the business continuity plans for our key partners here:

- Vanderbilt Financial Group (our back office) has a detailed plan which you can read here.

- Fidelity Investments (our primary custodian) makes it’s plan available here.

- TD Ameritrade (our custodian for Orion accounts) makes it’s plan available here.

- We have been in contact with our other vendors and technology partners, including Emoney, Albridge, Orion and others. We are confident in their abilities to maintain a consistent level of service as the COVID-19 pandemic continues to spread.

- Our second priority is making sure that our firm is protected so that we can continue to serve our clients. Too many people rely on us for us to get sick. Here are the steps we’re taking:

-

- Our office functions almost entirely on cloud based systems. Our phones, trading system, meeting platforms, website, and client files are all hosted on separate secure cloud servers with redundant backups. We converted to these systems in the wake of Hurricane Sandy, and have been training and preparing for the next disaster since then. We have relied on these systems to continue working from the road at conferences in the past, and have full confidence in our ability to continue to serve our clients from anywhere with a stable internet connection and a power outlet.

- We re-configured our scheduling tool to provide additional clarity and make additional options available to our clients, while restricting non-client meetings. Our firm has offered Virtual meetings for years, and we’re extremely comfortable meeting over video chat with screen-sharing. To protect both ourselves and our clients, we are encouraging everyone to meet with us virtually or over the phone.

- Give the new configuration of our scheduling tool a spin below! We’re here to talk. Please feel free to use it to find a time to chat, even if you only have a quick question (there’s an option for that!)

-