Climate Risk in Passive Investing

We’ve been seeing a lot of articles recently about a “bubble” in passive (index) investing. We haven’t commented much on this trend, as we’re big fans of low cost index funds in our portfolios. However, an article came out yesterday in Forbes that makes a point connected with this debate that we agree with wholeheartedly. Jeff McMahon writes in his article “Index Funds Face Heightened Risk From Climate Change” that Index funds are uniquely exposed to the systematic risks faced by climate change, and specifically to the inevitable policy response to climate change.

The Principles For Responsible Investing (PRI) (of which we are a signatory) has been doing a lot of research on this (see here for more information, or click here to view the slides from a recent event we attended with the PRI). We have incorporated this viewpoint into our portfolios, and the way we’ve done it speaks directly to McMahon’s article from yesterday.

McMahon points to the recent testimony before Congress from Alicia Seiger, the Managing Director of Stanford’s Sustainable Finance Initiative, who argues that investors are less able to manage climate risk because they are less able to monitor it (you can read her entire testimony here). We completely agree with this for the vast majority of index funds on the market today, but in our practice we have discovered that there are a number of ESG approaches that can be used to manage this risk (see this blog post from earlier this year for more information). Further, by looking at the PRI’s research, we believe we can identify the most likely policy responses and manage these risks within our portfolios.

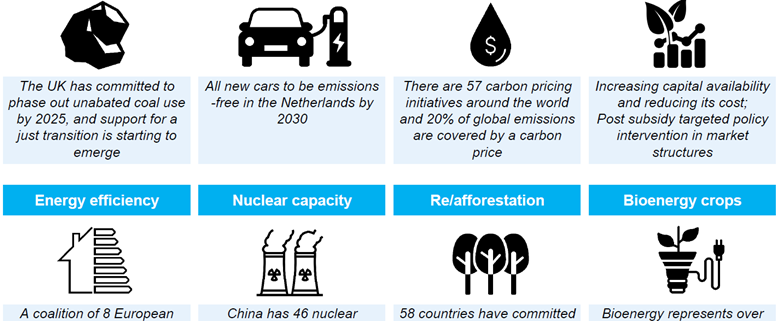

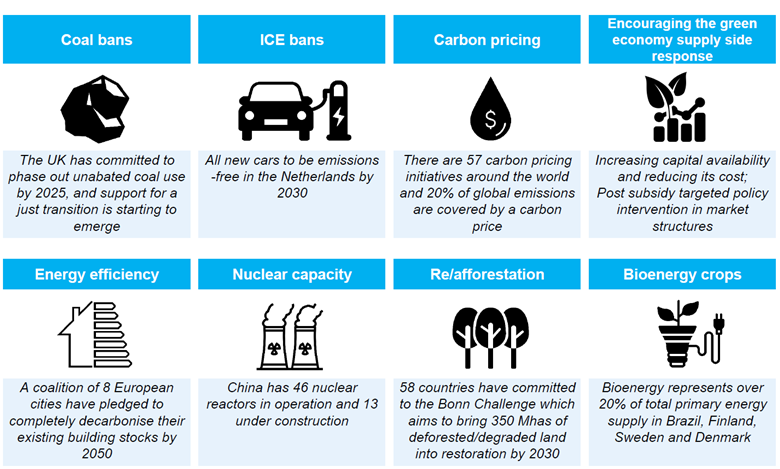

The most likely policy levers to secure an accelerated and just transition Source: UNPRI (https://www.unpri.org/climate-change/what-is-the-inevitable-policy-response/4787.article)

By mindfully choosing investments that incorporate Environmental, Social and Governance data in their investment process, we believe we can manage these risks. However, there are a number of different approaches emerging within the investment community, and they do not all have the same results! If you are interested in what we’re doing to manage these risks in our portfolios, or if you would like us to analyze your investments to see how exposed you are to these risks, click here to schedule an appointment!