We’re committed to working for you, with you.

Common Interests was formed in 1994 after Bob Goellner got his big office in the corner as manager of a mid-sized insurance and stock brokerage branch. Succeeding by every available metric, he realized he wanted to move beyond the way the industry worked at the time, and resolved to strike off on his own. Eventually he hired Max, who had been a client of the firm and shared his values, to learn the business and become his successor. Together with their team, they help clients navigate anything related to personal finance, while aligning their investments with their values.

The name comes from the way we choose to work with clients. When we work together, our interests become common. There are no winners, no losers, and nobody comes out on top. Problem solving comes first, and any products we discuss are only presented as tools to solve whatever issue brought you into our office.

Our story concludes with our logo: the world in an eye. This is the driver, the mechanism that meets the standards of social responsibility while looking ahead to a bright future; for ourselves and the global village in which we live.

Our Practice

Social responsibility lies at the core of our Practice. At Common Interests, we start our investment process in the same place as the rest of the industry: with the fundamentals of the companies we invest in. We look at balance sheets, price-earnings ratios, and the rest of each company’s financial statistics. The difference comes when we overlay our values system on the investments we choose.

We view long term investing as casting a vote. For the core of our portfolios, we refuse to cast that vote for companies that are messing up our planet, treating their people in ways we wouldn’t want to be treated, or “cooking the books.” Investments are filtered through Environmental, Social and Governance (ESG) screens to ensure we’re having the most impact.

The team at Common Interests is proud to be active citizens of our community and the world. We are an award-winning certified B-Corporation and signatories of the UN’s Principles of Responsible Investment.

Our Team

Robert J. Goellner CFP®, ChFC, CLU

bob@commoninterestsfinancial.com

Bob founded Common Interests in 1994 to combine his professional career with his personal values of making the world a better place. He began his management career in financial services at the New York Life Insurance Company in 1967 and brings over 55 years of experience to each client interaction.

Click here to check Bob’s background on FINRA’s BrokerCheck

Bob’s first career was as a Methodist Minister. This path began at Allegany College, through the Drew University Seminary, and culminated with a “Three Church Charge” in the Catskill mountains, where Bob was responsible for three church services each Sunday at different churches (ask him to tell this story, it’s a good one). While he thoroughly enjoyed his Ministry, he found the world of business and entrepreneurship was his true field of endeavor!

While with New York Life, and later with the Acacia Group, he served in the capacities of sales representative, sales manager, training supervisor, advance trainer and branch manager.

Bob has been a Certified Financial Planner® since 1985, a Chartered Financial Consultant since 1983, a Chartered Life Underwriter since 1976. Interesting enough, Bob taught and sat for each of these designations with his own students! He holds securities registrations as a Registered Representative-General Securities, and Registered Securities Principal.

Bob has a long history of being highly involved in his community. Currently he serves as a Trustee of the Muhlenberg Hospital Foundation. In the past he was President & Founder of the North Plainfield Education Foundation, President of the Woodbridge Chamber of Commerce and a Trustee on the Board of the Watchung Ave. Presbyterian Church. Bob’s commitment to his work has led him to maintain active memberships in the Financial Planning Association, the Financial Services Institute, and the Social Investment Forum.

Bob is a proud veteran of the U.S. Army where he served as a chaplain’s assistant in Vietnam. He was recommended for a Bronze Star for Service and was ultimately awarded the Army Commendation Medal. Until Covid arrived, Bob can be found most nights playing his trombone in the 18-piece Nostalgia Big Swing Band, the Westfield Community Concert Band and the Somerset Brass Quintet, and/or as a member, and substitute conductor, of his church choir.

Max Mintz

max@commoninterestsfinancial.com

Max Mintz joined Common Interests in 2012. His specialties include Student Loans, Impact Investing and the trading and re-balancing of our client accounts. Max is proud to have been named a "40 under 40" Financial Advisor by the InvestmentNews in 2019.

You can learn more about Max in this feature that ran in Morningstar Magazine’s Q1 2022 Issue

Click here to check Max’s background on FINRA’s BrokerCheck

Max first discovered Responsible Investing as a client of Bob’s. In the process of obtaining his degree in Philosophy at Rutgers College, he discovered an interest in Ethics, and while he never expected to be in finance, he found his calling by connecting his studies with his interest in Economics and data analysis. Max has a passion for helping clients align their investments with their values and relies on his ethics training to help clients balance tradeoffs through the process of expressing their values in their portfolios.

Max previously served 2 terms as the Treasurer for the Alliance for New Jersey Environmental Education – he takes pride in his support for educators working on the front lines educating the next generation to become responsible stewards of the environment. He also speaks on topics related to Financial Planning, Sustainable Investing, and Common Interests’ work as a Social Enterprise to various industry and interest groups – let him know if you’d like him to speak at an event!

Max Mintz is Series 7 and 66 licensed as a Financial Advisor with Vanderbilt Financial Group.

Ruth E. Arriaza

ruth@commoninterestsfinancial.com

Ruth joined Common Interests in 2014 and is the glue of the firm. Her career began in the Pharmaceutical Industry, where she specialized in data management. She has a Bachelors’ degree in Medical Technology and experience in analytical chemistry, report writing, scientific research, and the entry and management of clinical pharmacology data.

Ruth passed the last of her securities exams in 2022 and is in training to become an advisor in her own right. Click here to check Ruth’s background on FINRA’s BrokerCheck

Ruth’s unique skillset complements the team in an amazing way servicing accounts; connecting and supporting clients, and making sure nothing falls through the cracks. Ruth is fully bilingual in English and Spanish so at Common Interests “Se habla Español”. Ruth keeps busy when out of the office by volunteering her time as administration chair for a non-for-profit organization in North Plainfield. In her spare time, she enjoys reading, playing the piano, and gardening.

Ruth Arriaza is a registered Assistant with Vanderbilt Financial Group.

Saachi Sharda

Saachi@commoninterestsfinancial.com

Saachi joined Common Interests in January of 2022, and is an essential member of our team, coordinating paperwork, managing our social media channels as well as maintaining client relationships and acting as the first line of communication for all our clients.

We’re thrilled to welcome Saachi as the newest member of our team as of January 2022! Saachi has a Bachelor’s in mass media from the University of Mumbai and a Master’s in International Management from the University of Strathclyde in Glasgow, Scotland. Being part of something which helps build a better future not only for herself but for the people around her has always been at the heart of what she does in life, which closely aligns with our values. She has already started to improve the quality of our communications with our clients, and we’re excited to grow our team.

Saachi Sharda is a non-registered assistant with Vanderbilt Financial Group.

Wicket

Named for the Ewok who rescues Princess Leia in Return of the Jedi , Wicket is responsible for greeting our clients at the door, being a comforting presence in our client meetings, and demanding that we go home at a reasonable hour.

He also has an important message to share (click to make it bigger):

Common Interests is a Certified B Corp!

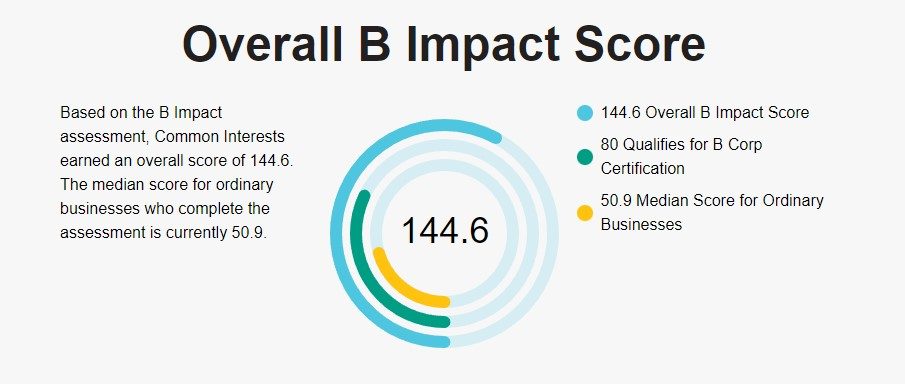

We believe that trust needs to be earned. Our clients trust us with so much, that we wanted to go an extra step to proritize transparency. To this end, Common Interests became a Certified B Corporation in 2014 to “put our money where our mouth is” by having the independent organization B Lab audit our business practices. We believe that our investments should practice transparency by disclosing their Environmental, Social, and Governance (ESG) standards and performance, and we hold ourselves to the same standard. It’s important to us that our clients see and understand our business practices as well as our commitment to sustainability. As part of this, we commit to having at least 75% of our clients be local and independent. And we only surround ourselves with like-minded individuals and companies—those that believe in giving back and making the world a better place. We invite you to view our historic al scores and public disclosure of our B Impact Assessment (the tool used to certify B Corps) on B Lab’s website, which you can find by clicking here.

What is a B Corp?

B Corp is to business what Fair Trade certification is to coffee or USDA Organic certification is to milk.

B Corps are for-profit companies certified by the nonprofit B Lab to meet rigorous standards of social and environmental performance, accountability, and transparency.

Alongside Common Interests, there is a growing community of more than 2,400 Certified B Corps from 50+ countries and over 130 industries working together toward 1 unifying goal: to redefine success in business. Read more at bcorporation.net

We’ve been voted “Best for the World” – Six Times in a row!

For the Sixth time in a row, Common Interests has been honored in the Best for Customers list! These businesses set the standard for serving their customers. By providing critical services like education, healthcare, and finance management, they add value to customers’ lives while supporting the greater good. These B Corps scored in the top 5% of the Customers portion of the B Impact Assessment which measures the impact a company has on its customers through their products or services.

The Customer portion of the B Impact Assessment measures the impact a company has on its customers by focusing on whether a company sells products or services that promote public benefit and if those products/services are targeted toward serving underserved populations. The section also measures whether a company’s product or service is designed to solve a social or environmental issue (improving health, preserving environment, creating economic opportunity for individuals or communities, promoting the arts/sciences, or increasing the flow of capital to purpose-driven enterprises). Honorees scoring in the top 10 percent set a gold standard for the high impact that business as a force for good can make on consumers around the world. You can view the 2022 “Best for Customers” list by clicking here.